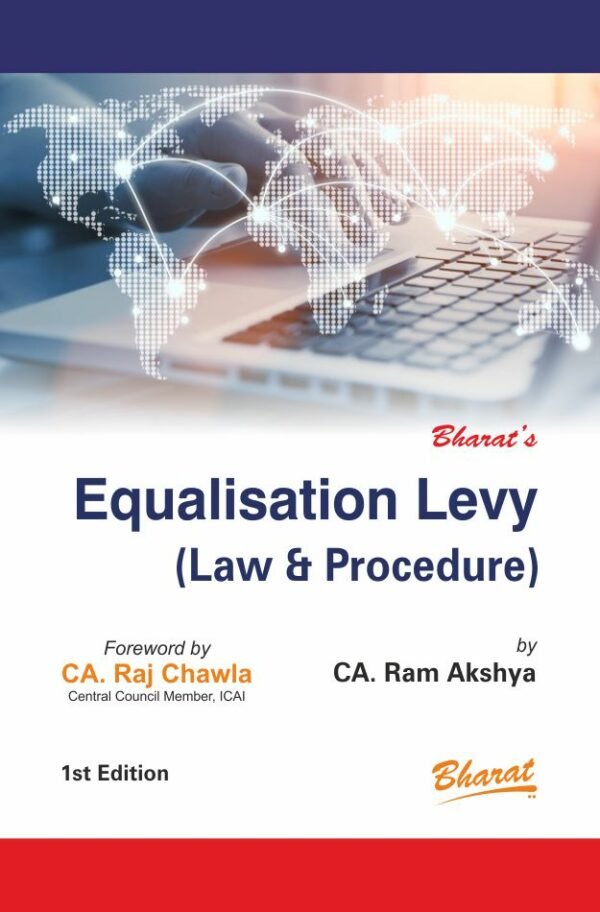

EQUALISATION LEVY (LAW & PROCEDURE) BY RAM AKSHYA

₹895.00

Bharat Equalisation Levy (Law & Procedure) By CA. Ram Akshya

Bharat Equalisation Levy (Law & Procedure) By CA. Ram Akshya

Content

Chapter 1 Equalisation Levy

Chapter 2 TDS under Income-Tax on E-Commerce Transactions

Chapter 3 Relevant Statutory Provisions, Notifications and Circulars

Chapter 4 Global Minimum Tax & OECD

Appendix 1 Tax Challenges Arising from the Digitalisation of the Economy — Global Anti-Base Erosion Model Rules (Pillar Two) Inclusive Framework on BEPS

Appendix 2 Tax Challenges Arising from the Digitalisation of the Economy — Commentary to the Global Anti-Base Erosion Model Rules (Pillar Two) Inclusive Framework on BEPS

Appendix 3 Tax Challenges Arising from the Digitalisation of the Economy — Global Anti-Base Erosion Model Rules (Pillar Two) Examples Inclusive Framework on BEPS

Appendix 4 Tax Challenges Arising from the Digitalisation of the Economy — Global Anti-Base Erosion Model Rules (Pillar Two) Inclusive Framework on BEPS

Appendix 5 Global Anti-Base Erosion Model Rules (Pillar Two) Frequently Asked Questions

Chapter 5 Brief Introduction to E-Commerce

Chapter 6 Types of E-Commerce

Chapter 7 Models of E-Commerce

Chapter 8 Functions of E-Commerce Operators

Additional information

| Binding | Paperback |

|---|---|

| Book author | RAM AKSHYA |

| ISBN | 9.78939E+12 |

| Publication | BHARAT LAW HOUSE (PVT) LTD |

| Year of Publication | 2022 |

Reviews

There are no reviews yet.