Sale!

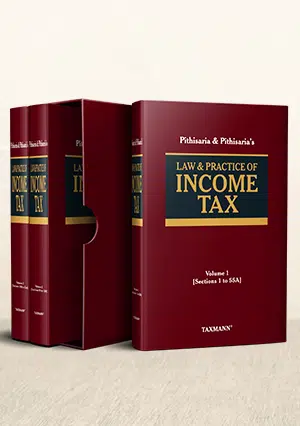

Taxmann’s Law & Practice of Income Tax by Pithisaria & Pithisaria – 1st Edition 2022

₹7,495.00

Taxmann’s Law & Practice of Income Tax (Set of 3 Vols.) by Pithisaria & Pithisaria – 1st Edition 2022.

Taxmann’s Law & Practice of Income Tax (Set of 3 Vols.) by Pithisaria & Pithisaria – 1st Edition 2022. Taxmann’s flagship section-wise commentary on Income-tax Act is also the most updated & amended. It is presented in a structured, integrated, interconnected, and short & concise format. This book exemplifies the Taxmann’s legacy of 60+ years and the unmatched 35 years’ experience of Mr M.K. Pithisaria.

Taxmann’s flagship section-wise commentary on Income-tax Act is also the most updated & amended. It is presented in a structured, integrated, interconnected, and short & concise format. This book exemplifies the Taxmann’s legacy of 60+ years and the unmatched 35 years’ experience of Mr M.K. Pithisaria.

This book will be helpful for tax practitioners of Income-tax, International Tax, Transfer Pricing, etc.

The Present Publication is the 1st Edition, amended by the Finance Act 2022 & updated till 14th July 2022. This book is authored by Adv. M.K. Pithisaria & CA Abhishek Pithisaria, with the following noteworthy features:

- [Flow of the Commentary]

- The content of each (operative) Section starts with the Section portion, followed by;

- The relevant Rule to that Section (if any) followed by;

- The commentary portion under the central heading ‘Comments’

- [Integrated Commentary] that cohesively integrates the following:

- Income-tax Act, 1961

- Income-tax Rules, 1962

- Notifications, Circulars, Instructions, etc. issued by the Central Board of Direct Taxes (CBDT) and the Central Government

- International literature on International Tax & Transfer Pricing

- [Interconnected Commentary]

- This commentary aims to help the reader comprehend the law logically, effectively, and efficiently

- The authors have given a para numbering and broad subject heading in the commentary on every Section, allowing you to navigate to the relevant portion quickly

- Each volume provides a detailed alphabetic subject index and list of cases that help you find the relevant discussion instantly

- [Comprehensive Commentary]

- The authors have explained every provision’s critical aspect and principles with judicial pronouncements, circulars, notifications, practical insights, and illustrations.

- The book covers the international literature on various aspects, including UN Model Tax Convention 2021, OECD TP Guidelines, and Expert Committee’s Report on GAAR

Additional information

| Binding | Hardcover |

|---|---|

| Book author | Pithisaria & Pithisaria |

| ISBN | 9.78936E+12 |

| Publication | TAXMANN PUBLICATIONS |

| Year of Publication | 2022 |

Reviews

There are no reviews yet.