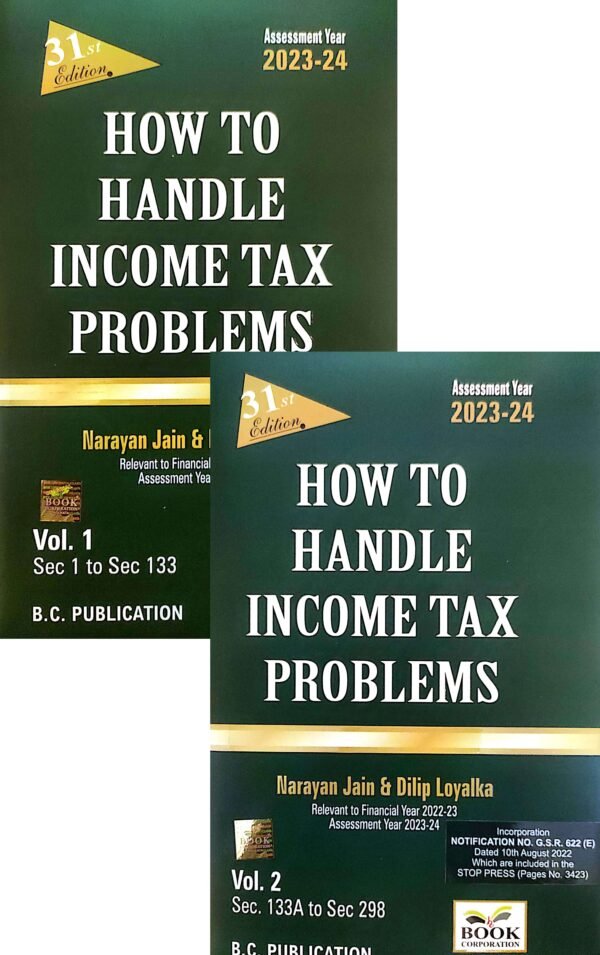

How to Handle Income Tax Problems by Narayan Jain & Dilip Loyalka (In 2 vols) 2022 Edn

₹4,495.00

Book Corporation How To Handle Income Tax Problems By Narayan Jain

Book Corporation How To Handle Income Tax Problems By Narayan Jain

Description

This award-winning book provides a comprehensive coverage to the complex subject of Income Tax and gives easy solutions to problems faced by tax-payers. The book gives practical solutions to income-tax problems arranged Section-wise. It incorporates the latest changes made by the Finance Act, 2022

Volume I – Part 1 : Tax Faqs & Solutions

Volume 2 – Part 2 : Tax Rates, Appeal Fees, Court Fees, Stamp Duty, Depreciation Rates, Gold And Silver Rates And Other Important Information

Part 3: Important CBDT Circulars, Notifications, Press Releases And Instruction Etc

Containing FAQs & practical problems and its solutions in easy to follow language with guidelines on art of handling the tax matters and ideas for tax-planning under various heads of income together with Tax rates

Additional information

| Binding | Hardcover |

|---|---|

| Book author | Narayan Jain & Dilip Loyalka |

| ISBN | 9.7882E+12 |

| Publication | BOOK CORPORATION |

| Year of Publication | 2022 |

Reviews

There are no reviews yet.