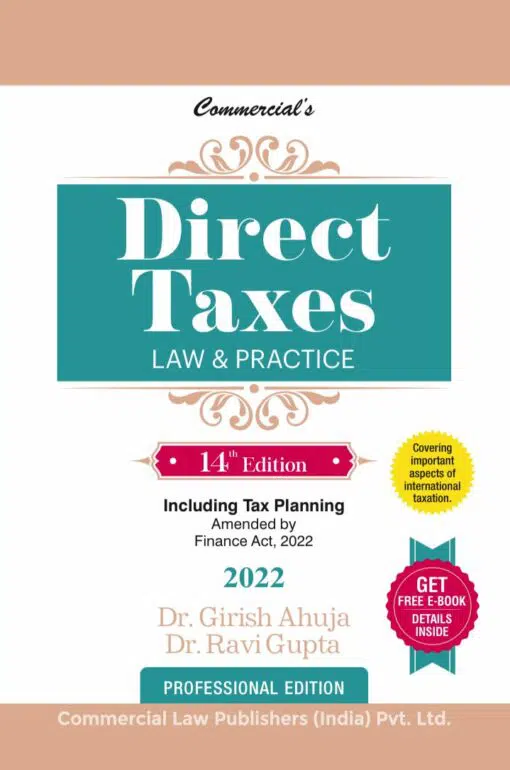

AHUJA & GUPTA’S DIRECT TAXES LAW & PRACTICE (AMENDED BY FINANCE ACT 2022)

₹2,517.00

Commercial’s Direct Taxes Law & Practice (Professional) By Dr Girish Ahuja & Dr Ravi Gupta – 14th Edition 2022.

Commercial’s Direct Taxes Law & Practice (Professional) By Dr Girish Ahuja & Dr Ravi Gupta – 14th Edition 2022.

Key Features :

The book has lucid commentary on Direct Tax Law & Practice with Illustrations, duly updated with all the recent amendments. It is a comprehensive and critical study of law relating to income-tax. It also includes gist of relevant CBDT Circulars and Notifications. The author has given references to the latest important Supreme Court & High Court Judicial pronouncements with relevant paragraphs at relevant places. The crux of every provision has been provided in a unique manner. At the end of every provision and illustration, a synopsis have been highlighted in a frame. The amendments made by the Finance Act, 2022 have been highlighted separately with the effective dates, at relevant places. A section-wise study with page and para referencing have been provided at the beginning of every chapter, which facilitates reader quick glance through.

Target Audience – Tax Professionals like Chartered Accountants, Lawyers, Cost Accountants etc. – Practicing Firms – Libraries of Colleges and Universities – CFOs and Corporate Tax Managers Students of Professional Courses.

About Authors:

Dr Girish Ahuja : Dr. Girish Ahuja did his graduation and post-graduation from Shri Ram College of Commerce, Delhi and was a position holder. He was awarded a Ph.D. degree by Faculty of Management Studies (FMS), Delhi University. He has been teaching Direct Taxes to students at various levels for more than 35 years. He is a Fellow of the Institute of Chartered Accountant of India (ICAI) and was a rank holder of both Intermediate and Final examinations of the Institute. He was a senior faculty member of Shriram College of Commerce (Delhi University) and also has been visiting faculty member of the Institute of Chartered Accountants of India (ICAI), Institute of Company Secretaries of India (ICSI) and various management institutes. He had been nominated by the Government to the Central Council of the Institute of Company Secretaries of India for two terms. He is a Special Invitee to the Fiscal Law Committee of ICAI and Editorial Board of ICSI. He is also on the Board of Directors of many reputed companies and has a vast and rich experience in the field of Finance and Taxation. He has also been appointed by the Govt. of India to the Central Board of Director of State Bank of India.

Dr. Ahuja has addressed more than 6000 seminars organized by the ICAI, ICSI, ICWAI, Chambers of Commerce.

Dr Ravi Gupta : Dr. Ravi Gupta did his graduation and post-graduation from Shri Ram College of Commerce. Thereafter, he did LL.B. from Delhi University and MBA (Finance) from Faculty of Management Studies, Delhi. He has been awarded a Ph.D. degree in International Finance by the Delhi University. He is a faculty member at Shri Ram College of Commerce (Delhi University) and also has vast practical experience in handling tax matters of trade and industry. He has been a visiting faculty member at The Indian Law Institute, The Institute of Company Secretaries of India, MFC (South Campus, Delhi University), MDI and various other Management Institutes. He has addressed more than 2000 seminars on Direct Taxes organized by ICAI, Chambers of Commerce, Universities, etc. He has been appointed by the Government of India as a member of the Committee constituted for Simplification of Income Tax Act. He is an independent director of many reputed companies. He has also been nominated Central council member of the Institute of Chartered Accountants of India by the govt. of India.

Additional information

| Binding | Hardcover |

|---|---|

| Book author | DR GIRISH AHUJA & DR RAVI GUPTA |

| Edition | 14th |

| ISBN | 9.78936E+12 |

| Publication | COMMERCIAL LAW PUBLISHERS (INDIA) PVT LTD |

| Year of Publication | 2022 |

Reviews

There are no reviews yet.