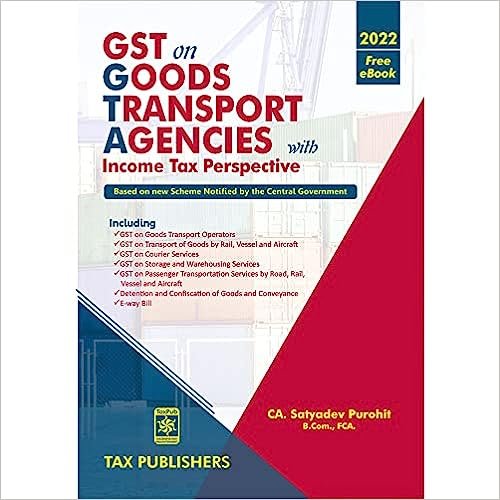

GST on Goods Transport Agencies with Income Tax Perspective by CA Satyadev Purohit – 2022 Edition

₹900.00

Description

A comprehensive write-up on the scheme of levy of GST on Goods Transport Agencies, Transport of Goods by other means, Transport of Passengers, Detention and Confiscation of Goods and Conveyance in Transit and E-way Bill Also comprising a brief write-up on Income tax provisions specific to Goods Transporters Divided into the following six parts, namely :-

Part I: Overview of GST law

Part II: GST on Goods Transport Agencies and Transport of Goods by Other Means

Part III: GST on Passenger Transport Services

Part IV: Detention and Confiscation of Goods and Conveyance in Transit

Part V: E-way bill

Part VI: GTAs from Income Tax Perspective The updated text is based on the law as amended in the wake of the Finance Act, 2022

The ratio of the relevant judicial pronouncement as well as Notifications and Circulars are incorporated in the relevant text. Useful for Chartered Accountants, Tax Consultants and GST Practitioners.

Additional information

| Binding | Paperback |

|---|---|

| Book author | CA Satyadev Purohit |

| Edition | 2022 |

| Publication | Tax Publishers |

Reviews

There are no reviews yet.