Sale!

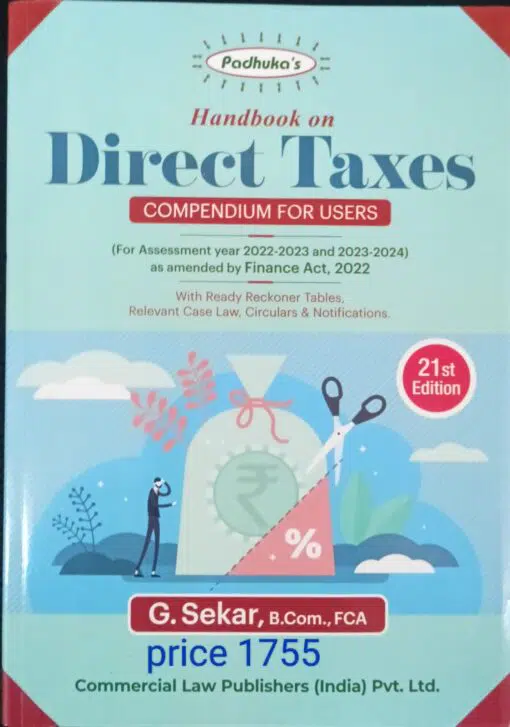

COMMERCIAL’S HANDBOOK ON DIRECT TAXES(Compendium) FOR AY 2022-23 & 2023-24 (AS AMENDED BY FINANCE ACT, 2022)

₹1,316.00

Commercial’s Handbook on Direct Taxes for Assessment Year 2022-23 and 2023-24 by G Sekar – 21st Edition 2022.

Commercial’s Handbook on Direct Taxes for Assessment Year 2022-23 and 2023-24 by G Sekar – 21st Edition 2022.

About the book

Features/Highlights

- Updated with Amendments made by Finance Act. 2022

- All recent & relevant Circulars. Notifications. Press Releases & Court Decision updated.

- Referencer Tables for Individuals. HUF. AOP. B01. AJP. Firms. Companies. Co-operative Societies for 10 assessments years.

- Highlights and Summaries of Important Provisions/Contents of Direct Tax Laws under Fast Track Referencer.

- Highly useful Fast Track Reference with 12 Segments.

- Summary of Depreciation Schedule. Forms of Companies Act. 2013.

- Overview of all Accounting Standards issued by ICAI.

- Highly appreciated by IT Department Officials as an immediate Reference Book and User- Friendly Reckoner.

- Only Book having Relevant Case Laws. Circulars and Notifications.

Beneficiaries & Users of this Book include

- Office of the Comptroller and Auditor General of India

- Office of the Central Board of Direct Taxes. Chief Commissioners of Income-Tax for use by the Officers of TDS Wing, as well as DDOs

- National Academy of Direct Taxes. Ministry of Finance. Nagpur.

- Various Nationalized Banks like Indian Bank. State bank of India. Canara Bank. Corporation Bank etc. for use at their Branches.

- Various Companies and Firms in the Manufacturing and Service Sector.

- Finance. Investment & Legal Professionals in practice & service.

Out of stock

Additional information

| Binding | Paperback |

|---|---|

| Book author | G SEKAR |

| ISBN | 9.78936E+12 |

| Publication | COMMERCIAL LAW PUBLISHERS (INDIA) PVT LTD |

| Year of Publication | 2022 |

Reviews

There are no reviews yet.