Sale!

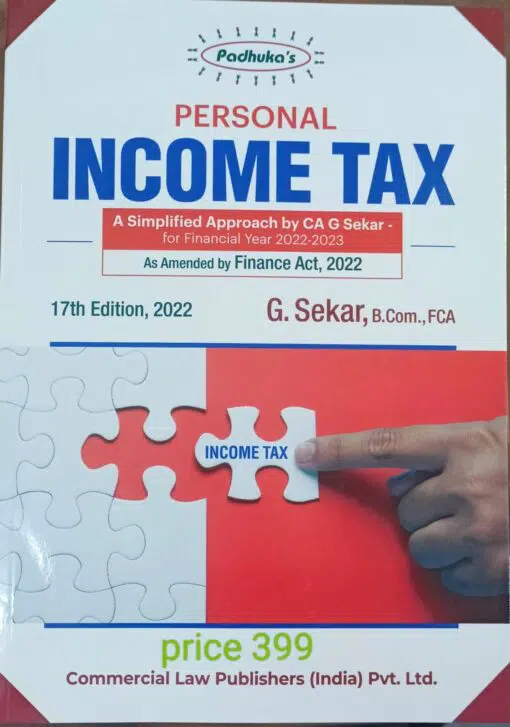

PADUKA’S PERSONAL TAX (BY G SEKAR) AS AMENDED BY FINANCE ACT 2022

₹299.00

Commercial’s Personal Income Tax – A Simplified Approach for Financial Year 2022-23 by G Sekar – 17th Edition 2022.

Commercial’s Personal Income Tax – A Simplified Approach for Financial Year 2022-23 by G Sekar – 17th Edition 2022.

About the book

Highlights of the book to be included:

- Simplified Handy book for Individuals to Understand Income Tax Law

- Comprehensive Guide for Tax Planning including Investment Plans

- Amendments by Finance Act, 2022 incorporated at respective Topics

- Coverage of various Exemptions, Relief including VRS Compensation, Arrears of Salary, etc.

- Tax Referencer Tablets for Individuals & HUF

- Comprehensive procedures on computation of Income under the head “Salaries” & “Income from House Property”.

- Ready Referencer for TDS and TCS Rates

- Incorporated all amendments and circulars & Notifications upto date

- Provisions relating to filing of Returns of individuals.

Beneficiaries & Users of this Book include…

- Office of the Comptroller and Auditor General of India.

- Office of the Central Board of Direct Taxes, Chief Commissioners of Income-Tax for use by the Officers of TDS Wing, as well as DDOs.

- National Academy of Direct Taxes, Ministry of Finance, Nagpur

- Various Nationalized Banks like Indian Bank, State Bank of India, Canara Bank, Corporation Bank etc. for use at their Branches.

- Various Companies and Firms in the Manufacturing and Sen/ice Sector.

- Accounting, finance, Investment & Legal Professionals- in practices & service.

Out of stock

Additional information

| Binding | Paperback |

|---|---|

| Book author | G SEKAR |

| Edition | 17th |

| ISBN | 9.78936E+12 |

| Publication | COMMERCIAL LAW PUBLISHERS (INDIA) PVT LTD |

| Year of Publication | 2022 |

Reviews

There are no reviews yet.