-

- Out of StockSale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

A 360° Approach to Presumptive Taxation by CA. R.S. Kalra – 1st Edition 2023

- ₹395.00

- A 360° Approach to Presumptive Taxation by CA. R.S. Kalra – 1st Edition 2023

- Read more

-

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

A 360° Approach to PRESUMPTIVE TAXATION by R.S. KALRA – 3rd Edition 2025

- ₹520.00

- A 360° Approach to PRESUMPTIVE TAXATION by R.S. KALRA - 3rd Edition 2025

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

A Comprehensive Guide to the GST Practitioner’s Examination (with MCQs) by Rajeev Babel – 4th Edition 2025

- ₹1,275.00

- A Comprehensive Guide to the GST Practitioner's Examination (with MCQs) by Rajeev Babel - 4th Edition 2025

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

A Guide to the Immigration Act 2016 by Alison Harvey – Edition 2017

- ₹5,645.00

- A Guide to the Immigration Act 2016 by Alison Harvey - Edition 2017

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

A Possibility of Decentralised and Inclusive Network by B A Pradeep Kumar 2024

- ₹515.00

- Highlights of this Book Can Traditional CA Firms Sustain and Flourish by Joining Networks Association of Persons (AOP) – The Game Changer Insights of Alliance & Concept of Sub Alliance Are my firms revenueprofits taken away by other firms? Can Chartered Accountants and Clients trust Alliances? Alliance Growth Prospects Technologies to Enhance Chartered Accountants Mobility

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

A Practical Approach to Civil Procedure by Stuart Sime – 26th Edition 2024

- ₹4,955.00

- A Practical Approach to Civil Procedure by Stuart Sime - 26th Edition 2024

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

A Practical Approach to Conveyancing by Mark Richards – 25th Edition 2024

- ₹4,855.00

- A Practical Approach to Conveyancing by Mark Richards - 25th Edition 2024

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

A Practical Approach to TAXATION AND ACCOUNTING OF CHARITABLE TRUSTS, NGOs & NPOs by CA. (Dr.) N. Suresh – 11th Edition 2025

- ₹2,435.00

- A Practical Approach to TAXATION AND ACCOUNTING OF CHARITABLE TRUSTS, NGOs & NPOs by CA. (Dr.) N. Suresh - 11th Edition 2025

- Add to basket

-

- Out of StockSale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

A Practical Guide to Capital Gains Tax, Securities Transaction Tax and Gift Tax by PL. Subramanian – 19th Edition 2023

- ₹1,180.00

- A Practical Guide to Capital Gains Tax, Securities Transaction Tax and Gift Tax by PL. Subramanian – 19th Edition 2023

- Read more

-

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

A Practical Guide to CAPITAL GAINS TAX, SECURITIES TRANSACTION TAX AND GIFT TAX BY PL. Subramanian 20TH EDITION 2024

- ₹1,270.00

- Explains Whole Gamut of Capital Gains Tax in Simple Language

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

A Research Agenda for Entrepreneurial Cognition and Intention by Alan L. Carsrud – Edition 2018

- ₹11,395.00

- A Research Agenda for Entrepreneurial Cognition and Intention by Alan L. Carsrud - Edition 2018

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

All About Income Tax Appeals in Faceless Era by CA. Nisha Bhandari – Edition 2024

- ₹1,850.00

- All About Income Tax Appeals in Faceless Era by CA. Nisha Bhandari - Edition 2024

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

All About Income Tax Appeals in Faceless Era Including GST Appeals by CA NISHA BHANDARI & CA SATYADEV PUROHIT – Edition 2023

- ₹1,685.00

- All About Income Tax Appeals in Faceless Era Including GST Appeals by CA NISHA BHANDARI & CA SATYADEV PUROHIT - Edition 2023

- Add to basket

-

- Out of StockSale!

- COMPANY LAW, CORPORATE LAWS, BUSINESS LAW, SEBI, SECURITIES, STOCK, FEMA, COMPETITION, TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

All About Private Companies by Amit Baxi – Edition 2023

- ₹1,775.00

- All About Private Companies by Amit Baxi - Edition 2023

- Read more

-

-

- Sale!

- COMPANY LAW, CORPORATE LAWS, BUSINESS LAW, SEBI, SECURITIES, STOCK, FEMA, COMPETITION, TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

All About Private Companies by Amit Baxi – Edition 2024

- ₹1,775.00

- All About Private Companies by Amit Baxi - Edition 2023

- Add to basket

-

- Out of StockSale!

- CONTRACT LAW & SPECIFIC RELIEF, PARTNERSHIP, SALE OF GOODS, TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

All About Trusts & NGOs by CA. Chunauti H. Dholakia – 2nd Edition 2023

- ₹1,180.00

- All About Trusts & NGOs by CA. Chunauti H. Dholakia – 2nd Edition 2023

- Read more

-

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

An Analysis of GST Advance Rulings – Important Propositions by Krupa Venkatesh – 1st Edition 2023

- ₹520.00

- An Analysis of GST Advance Rulings - Important Propositions by Krupa Venkatesh - 1st Edition 2023

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

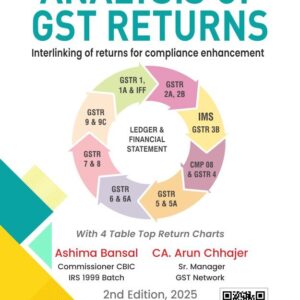

ANALYSIS OF GST RETURNS by ASHIMA BANSAL & CA. ARUN CHHAJER – 2nd Edition 2025

- ₹895.00

- ANALYSIS OF GST RETURNS by ASHIMA BANSAL & CA. ARUN CHHAJER - 2nd Edition 2025

- Add to basket

-

- Sale!

- ADMINISTRATIVE LAW/JUDICIAL PROCESS, TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

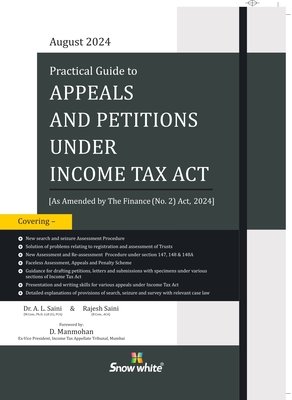

Appeals And Petitions Under Income Tax Act by Dr. A.L. Saini – Edition 2024

- ₹1,270.00

- Appeals And Petitions Under Income Tax Act by Dr. A.L. Saini - Edition 2024

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

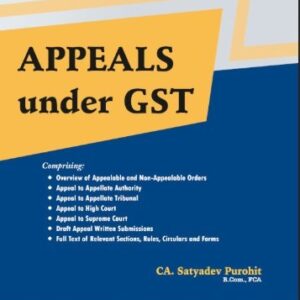

Appeals under GST, 2025 by CA. SATYADEV PUROHIT – Edition 2025

- ₹1,005.00

- Appeals under GST, 2025 by CA. SATYADEV PUROHIT - Edition 2025

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

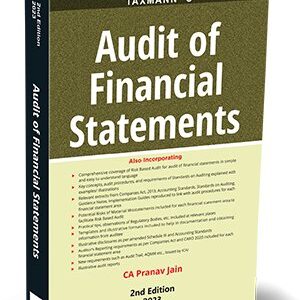

Audit of Financial Statements by Pranav Jain – 2nd Edition 2023

- ₹1,425.00

- Audit of Financial Statements by Pranav Jain - 2nd Edition 2023

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Audit of Financial Statements By Pranav Jain – 3rd Edition 2024

- ₹1,785.00

- Audit of Financial Statements By Pranav Jain - 3rd Edition 2024

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Audit Trail – A Practical Guide by CA. Kamal Garg – 2nd Edition 2024

- ₹550.00

- Audit Trail - A Practical Guide by CA. Kamal Garg - 2nd Edition 2024

- Add to basket

-

- Sale!

- CA Intern Books, TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Auditing and Ethics Made Easy for CA Inter by CA Ravi Kanth Miriyala – 8th Edition 2024

- ₹590.00

- Auditing and Ethics Made Easy for CA Inter by CA Ravi Kanth Miriyala - 8th Edition 2024

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Bank Audit – A Practical Guide for Bank Auditors by Anil K.Saxena – 7th Edition 2025

- ₹955.00

- Bank Audit - A Practical Guide for Bank Auditors by Anil K.Saxena - 7th Edition 2025

- Add to basket

-

- Sale!

- Custom Tax, TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

BDP’s Customs Tariff with IGST and Foreign Trade Policy (in 3 Part’s) by Anand Garg

- ₹3,515.00

- BDP's Customs Tariff with IGST and Foreign Trade Policy (in 3 Part's) by Anand Garg

- Add to basket

-

- Sale!

- GENERAL READING, JURISPRUDENCE & MISCELLANEOUS, TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

BDP’s Foreign Trade Policy with Handbook of Procedures 2023 by Anand Garg

- ₹1,886.00

- BDP's Foreign Trade Policy with Handbook of Procedures 2023 by Anand Garg

- Add to basket

-

- Sale!

- CA Intern Books, TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Beginner’s Guide to Ind-AS & IFRS by CA. Kamal Garg – 4th Edition 2024

- ₹650.00

- Beginner’s Guide to Ind-AS & IFRS by CA. Kamal Garg - 4th Edition 2024

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Benami Black Money & Money Laundering Laws by Taxmann – Edition 2025

- ₹1,095.00

- Benami Black Money & Money Laundering Laws by Taxmann - Edition 2025

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Beswick and Wine: Buying and Selling Private Companies and Businesses by Susan Singleton – Edition 2018

- ₹15,800.00

- Beswick and Wine: Buying and Selling Private Companies and Businesses by Susan Singleton - Edition 2018

- Add to basket

-

- Out of StockSale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Bharat Audit Trail – A Practical Guide by CA. Kamal Garg edition 2023

- ₹425.00

- About Audit Trail - A Practical Guide Chapter 1 Introduction Chapter 2 Difference in financial years for accounting (FY 2023-24) and auditing (FY 2022-23) – A conundrum Chapter 3 Audit trail for books of accounts or accounting software Chapter 4 Whether appropriateness of audit trail needs to be assessed retrospectively Chapter 5 Accounting Software – one for books of accounts and another for financial statements Chapter…

- Read more

-

-

- Sale!

- CONTRACT LAW & SPECIFIC RELIEF, PARTNERSHIP, SALE OF GOODS, CONVEYANCING, DEEDS, DRAFTING, PLEADING, TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

BHARAT COMMERCIAL CONTRACTS BY R.KUMAR

- ₹1,950.00

- Chapter 1 Commercial Contracts Chapter 2 Basics of Contract Chapter 3 Contracts — Basic Elements Chapter 4 Contract and Risk Management Chapter 5 Non-Disclosure Agreement Chapter 6 High Sea Sales Agreement Chapter 7 After Sales and Service Agreement Chapter 8 Annual Computer Maintenance Agreement Chapter 9 Software Licencing Agreement Chapter 10 Local Supply Agreement Chapter 11 Asset Purchase Agreement Chapter 12 Training Agreement Chapter 13 Installation and Commissioning Agreement Chapter 14 Business Processing Outsourcing…

- Add to basket

-

- Out of StockSale!

- COMPANY LAW, CORPORATE LAWS, BUSINESS LAW, SEBI, SECURITIES, STOCK, FEMA, COMPETITION, TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Bharat Companies Act with Rules – 41st Edition 2024

- ₹1,725.00

- Companies Act with Rules - 41st Edition 2024

- Read more

-

-

- Out of StockSale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Bharat Goods and Service Tax Ready Reckoner by Ashok Batra – Edition 2025

- ₹2,320.00

- Bharat Goods and Service Tax Ready Reckoner by Ashok Batra - Edition 2025

- Read more

-

-

- Out of StockSale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

BHARAT GST Law Simplified – 1st Edition 2023

- ₹875.00

- GST Law Simplified - 1st Edition 2023

- Read more

-

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Bharat GST Law Simplified with Forms,Tariff And Exemptions by P.K. Goel – 2nd Edition 2024

- ₹1,045.00

- Bharat GST Law Simplified with Forms,Tariff And Exemptions by P.K. Goel - 2nd Edition 2024

- Add to basket

-

- Out of StockSale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Bharat GST Ready Reckoner by CA . ASHOK BATRA 7th edn., 2023

- ₹1,870.00

- GST Compliance Calendar for February, 2023 to March, 2024 Referencer 1 Meanings of various terms used in GST Referencer 1A Meanings of legal words, maxims/phrases Referencer 1B Rules of interpretation of statutes including Doctrines Referencer 2 Extension of due dates for different returns Referencer 3 State/UT Codes Referencer 4 Rate of interest payable under different situations Referencer 5 Important issues regarding Summon under section 70 of the…

- Read more

-

-

- Out of StockSale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Bharat GST Ready Reckoner by CA Ashok Batra 8th Edition 2023

- ₹1,945.00

- About GST Ready Reckoner Division 1 Referencer GST Compliance Calendar for April, 2023 to March, 2024 Referencer 1 Meanings of various terms used in GST Referencer 1A Meanings of legal words, maxims/phrases Referencer 1B Rules of interpretation of statutes including Doctrines Referencer 2 Extension of due dates for different returns Referencer 3 State/UT Codes Referencer 4 Rate of interest payable under different situations Referencer 5 Important issues regarding Summon under…

- Read more

-

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Bharat GST Smart Guide by by Ramesh Chandra Jena 2nd edn., 2023

- ₹1,570.00

- Appendix Important Circulars Topic wise 1. Procedure for Cancellation of Registration 2. Valuation Mechanism 3. Input Tax Credit 4. Imports of Goods 5. Refund under GST 6. Tax Deduction at Source 7. Job Work under GST 8. Electronic Way Bill 9. Export procedure 10. Taxability of “Tenancy Rights” under GST 11. Micro, Small and Medium Enterprises 12. Casual Taxable Person and…

- Add to basket

-

- Out of StockSale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Bharat Handbook on G S T by CA. Raj K Agrawal 8th edn., 2023 May and Nov .2023 Exams

- ₹385.00

- Chapter 1 Concept of Indirect Taxes Chapter 2 Introduction to GST Chapter 3 Levy and Collection of GST Chapter 4 Concept of Supply Chapter 5 Place of Supply Chapter 6 Time of Supply Chapter 7 Value of Supply Chapter 8 Input Tax Credit Chapter 9 Computation of GST Liability Chapter 10 Registration Chapter 11 Tax Invoice, Credit and Debit Notes Chapter 12 Electronic Way Bill Chapter 13 Returns Chapter 14 Payment of Tax Chapter…

- Read more

-

-

- Sale!

- Budget Editions 2025, TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Bharat Handbook To Direct Taxes 2025 by Bomi F. Daruwala – 34th Edition 2025

- ₹1,795.00

- Handbook To Direct Taxes 2025 by Bomi F. Daruwala - 34th Edition 2025

- Add to basket

-

- Out of StockSale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Bharat Handbook To INCOME TAX RULES 27th edn., 2023

- ₹1,495.00

- About Handbook To INCOME TAX RULES Division 1 — Checklists & Tables 1 Prescribed Authorities under the Income Tax Rules/Act 2 Prescribed Audit Reports under the Income Tax Rules/Act 3 Prescribed Reports/Certificates from an Accountant under section 288(2), Explanation 4 Prescribed Applications, Notices, Declarations, Forms, etc. under the Income-tax Rules/Act 5 Prescribed certificates/statements/particulars to be furnished under the Income-tax Rules/Act 6…

- Read more

-

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

bharat How to handle GST Audit with real life case studies by CA. Arun Chhajer Md. Samar Adv. Nitin Sharma

- ₹550.00

- About How to handle GST Audit with real life case studies Chapter 1 Introduction Chapter 2 Case Studies Case 1: Audit of Registered Person Dealing in FMCG Goods Case 2: Audit of Registered Person in the Business of Automatic Data Processing Machines and Units Case 3: Audit of Registered Person Dealing in Computer Hardware & Software Case 4: Audit of Registered…

- Add to basket

-

- Out of StockSale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Bharat Income Tax Act -35th Edition 2024

- ₹2,025.00

- Income Tax Act -35th Edition 2024

- Read more

-

-

- Out of StockSale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Bharat Income Tax Act 34th Edition 2023

- ₹1,795.00

- 1.Income-tax Act, 1961 Text of sections Chronological list of Amendment Acts SUBJECT INDEX Appendix 1: Important Circulars and Notifications Appendix 2: The Finance Act, 2023 Income Tax THE FIRST SCHEDULE: Rates of Taxes PART I: Income Tax PART II: Rates for Deduction of Tax at Source in Certain Cases PART III: Rates for Charging Income-tax in Certain Cases, Deducting Income-tax…

- Read more

-

-

- Out of StockSale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

BHARAT INCOME TAX RULES with FREE e-book access 32nd edn., 2023

- ₹1,795.00

- About INCOME TAX RULES with FREE e-book access DIVISION ONE INCOME TAX & ALLIED RULES 1. The Income-tax Rules, 1962 Chronological list of amendments 2. The Income-tax Rules, 1962 Text of Rules and Forms Subject Index ANNEXURE 1: Income Computation and Disclosure Standards 3. The Income-tax (Certificate Proceedings) Rules, 1962 Text of Rules and Forms Chronological list of amendments Subject Index…

- Read more

-

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Bharat Notes & Workbook TAXATION For CA Inter Module 3 GOODS & SERVICES TAX by by CA. Arvind Tuli

- ₹480.00

- About Notes & Workbook TAXATION For CA Inter Module 3 GOODS & SERVICES TAX MODULE 3: G S T Section Chapter Name A Introduction to GST A1: Power to make law A2: Overview of GST A3: Taxes subsumed after GST A4: No of Acts of GST in India A5: GST Council A6: Items not covered under GST A7: Import of…

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Bharat Practical Guide to Assessment & Audit by CA Tarun Kr. Gupta Edition 2023

- ₹445.00

- Chapter 1Assessment Chapter 2Self-assessment Chapter 3Provisional assessment Chapter 4Scrutiny of returns Chapter 5Assessment of non-filers of returns Chapter 6Assessment of unregistered persons Chapter 7Summary assessment in certain special cases Appendix 1Forms Appendix 2 Circulars and Instructions DIVISION II DEPARTMENTAL AUDIT Chapter 8Audit Chapter 9Audit by tax authorities Chapter 10Special audit Appendix 1Forms Appendix 2 Circulars and Instructions Appendix 3 Suggested questionnaires…

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Bharat Taxation Regime for Online Gaming CA. R.S. Kalra Edition June 2023

- ₹285.00

- Chapter 1Introduction Chapter 2Legal Position of Online Fantasy Sports Gaming in India Chapter 3Models of Online Gaming Chapter 4Top Online Games in India Chapter 5Online Gaming – A Game of Chance or Skill Chapter 6Taxabilty of Online Gaming Income – upto 31.03.23 Chapter 7Taxabilty of Online Gaming w.e.f. 01.04.2023 Chapter 8TDS Provision Related to Online Gaming Chapter 9Computation of Tax…

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Bharat, Practical Guide to G S T on Automobile Industry by CA. Vikram Katariya CA. Shilpi Jain CA. Pradeep V. 2nd Edition., 2023

- ₹1,180.00

- About Practical Guide to G S T on Automobile Industry PART I: INTRODUCTION Chapter 1Introduction to Automobile Industry Chapter 2Overview of GST PART II: OUTWARD SUPPLIES Chapter 3Implications on Outward Supplies — OEM and Component Manufacturers Chapter 4Valuation under GST Chapter 5Classification, Rate of Tax and Exemptions — OEM and Component Manufacturers Chapter 6Automobile Dealers Chapter 7Authorised Service Centres & Garages…

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Bharat, T D S Ready Reckoner by Dr. B. Ramaswamy

- ₹470.00

- About T D S Ready Reckoner Chapter 1 Introduction to TDS (Tax Deducted at Source) Chapter 2 Tax Deduction at Source on Income from Salary, Income from Interest, Income from the Sale of Property, and Income from EPF Withdrawals Chapter 3 Tax Collection at Source Chapter 4 Highlights of amendments made by Finance Act, 2023 Chapter 5 Related Rule(s) under Income-Tax Rule Chapter 6 Prescribed…

- Add to basket

-

- Out of StockSale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Bharat’s GST ITC Draft Replies & Internal Controls by CA. Vishal G Poddar – 1st Edition 2023

- ₹775.00

- Chapter 1 Introduction Chapter 2 Blueprint of Drafting Chapter 3 ITC related notices and draft replies Chapter 4 Control Chart — Eligible/Ineligible with Reversal and Blocked ITC Chapter 5 Due dates of GSTR 3B and Relaxation in late Fees and Interest during COVID Chapter 6 Internal Control and Reconciliations Chapter 7 FAQ on New Format of GSTR 3B Chapter 8 Accounting Entries and ITC Documentations Chapter 9 TRAN 1/TRAN 2…

- Read more

-

-

-

-

Sale!

- Custom Tax, TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

BIG’s Easy Reference CUSTOMS TARIFF (Set of 2 Vols.) by Arun Goyal – 49 th Edition 2024

- ₹3,000.00

- BIG's Easy Reference CUSTOMS TARIFF (Set of 2 Vols.) by Arun Goyal - 49 th Edition 2024

- Add to basket

-

Sale!

-

- Sale!

- CRIMINAL LAWS, MINOR ACTS,PMLA,WHITE COLLAR CRIMES, SCST, TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Blackstone’s Magistrates’ Court Handbook 2024 by Bartholomew Dalton,Caroline Liggins – Edition 2024

- ₹5,946.00

- Blackstone's Magistrates' Court Handbook 2024 by Bartholomew Dalton,Caroline Liggins - Edition 2024

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Blackstone’s International Law Documents by Malcolm Evans – 16th Edition 2024

- ₹1,585.00

- Blackstone’s International Law Documents by Malcolm Evans - 16th Edition 2024

- Add to basket

-

- Sale!

- CRIMINAL LAWS, MINOR ACTS,PMLA,WHITE COLLAR CRIMES, SCST, TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Blackstones’ Handbook of Youths in the Criminal Courts by Gareth Branston,Naomi Redhouse,Mark Ashford – 3rd Edition 2024

- ₹6,427.00

- Blackstones’ Handbook of Youths in the Criminal Courts by Gareth Branston,Naomi Redhouse,Mark Ashford - 3rd Edition 2024

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Bridging the Prosperity Gap in the EU by Lars Oxelheim – Edition 2018

- ₹9,235.00

- Bridging the Prosperity Gap in the EU by Lars Oxelheim - Edition 2018

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Business Guide to Free Trade Agreements Country Wise Import Duty Ready Reckoner By Ajay Srivastava

- ₹2,395.00

- This book is about making good use of Free Trade Agreements (FTAs) for enhancing business profits. The book has two parts: (1) Business Guide: Provides a roadmap for integrating FTAs into a firm’s business strategy. It is also a step by step guide to understand if exporting or importing under an FTA will be beneficial for your product. Adopt your business…

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Business Succession Planning by Ravi Mamodiya – 2nd Edition 2023

- ₹600.00

- Business Succession Planning by Ravi Mamodiya – 2nd Edition 2023

- Add to basket

-

- Sale!

- CA Intern Books, TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

CA Inter Advanced Accounting (Problems and Solutions) by Parveen Sharma & Kapileshwar Bhalla – 3rd Edition 2024 with New Syllabus

- ₹1,095.00

- CA Inter Advanced Accounting (Problems and Solutions) by Parveen Sharma & Kapileshwar Bhalla - 3rd Edition 2024 with New Syllabus

- Add to basket

-

- Out of StockSale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

CAPITAL GAINS (Law & Practice) with Illustrations & Judicial Precedents by CA. Divakar Vijayasarathy – 5th Edition 2023

- ₹1,495.00

- CAPITAL GAINS (Law & Practice) with Illustrations & Judicial Precedents by CA. Divakar Vijayasarathy - 5th Edition 2023

- Read more

-

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Capital Gains (Law & Practice) with Illustrations & Judicial Precedents by CA. Divakar Vijayasarathy – 6th Edition 2024

- ₹1,715.00

- Capital Gains (Law & Practice) with Illustrations & Judicial Precedents by CA. Divakar Vijayasarathy - 6th Edition 2024

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

CAPITAL GAINS (Law & Practice) with Illustrations & Judicial Precedents by CA. Divakar Vijayasarathy – 7th Edition 2025

- ₹1,765.00

- CAPITAL GAINS (Law & Practice) with Illustrations & Judicial Precedents by CA. Divakar Vijayasarathy - 7th Edition 2025

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

CAPITAL GAINS TAX Law and Practice by TG SURESH – 6th Edition 2023

- ₹705.00

- CAPITAL GAINS TAX Law and Practice by TG SURESH - 6th Edition 2023

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Capital Gains Tax Law and Practice by TG Suresh – 7th Edition 2024

- ₹845.00

- Capital Gains Tax Law and Practice by TG Suresh - 7th Edition 2024

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Capital Taxation Law and Practice by P V Srinivasan – Edition 2024

- ₹1,195.00

- Capital Taxation Law and Practice by P V Srinivasan - Edition 2024

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Case Laws in Favour of Revenue on Direct Tax Laws by Ram Dutt Sharma – Edition 2025

- ₹2,175.00

- Case Laws in Favour of Revenue on Direct Tax Laws by Ram Dutt Sharma - Edition 2025

- Add to basket

-

- Out of StockSale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Centax GST Tariff of India (Set of 2 Volumes) by R K Jain – Edition 2025-2026

- ₹3,270.00

- Centax GST Tariff of India (Set of 2 Volumes) by R K Jain - Edition 2025-2026

- Read more

-

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Chain Reactions in Criminal Justice by Maartje Van Der Woude – Edition 2016

- ₹2,955.00

- Chain Reactions in Criminal Justice by Maartje Van Der Woude - Edition 2016

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Challenges in Domestic & International Taxation

- ₹955.00

- Challenges in Domestic & International Taxation

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Chambers’ Corporate Governance Handbook by Porfessor Andrew D Chambers – Edition 2017

- ₹11,285.00

- Chambers' Corporate Governance Handbook by Porfessor Andrew D Chambers - Edition 2017

- Add to basket

-

- Sale!

- CONTRACT LAW & SPECIFIC RELIEF, PARTNERSHIP, SALE OF GOODS, TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Charitable And Religious Trusts and Institutions by S Rajaratnam – 20th Edition April 2024

- ₹895.00

- About CHARITABLE AND RELIGIOUS TRUSTS AND INSTITUTIONS AS AMENDED BY THE FINANCE (NO. 2) ACT, 2024 A DIGEST ON FORMATION, ADMINISTRATION & TAX MANAGEMENT Revised Registration Procedure Condonation of delay reintroduced Inter Charity Application of Income Merger of the first regime with the second regime Procedure for Approval under Section 80G

- Add to basket

-

- Sale!

- CONTRACT LAW & SPECIFIC RELIEF, PARTNERSHIP, SALE OF GOODS, TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Charitable And Religious Trusts and Institutions by S Rajaratnam – 22ND Edition 2024

- ₹2,695.00

- About LAW AND PROCEDURE ON CHARITABLE TRUSTS AND RELIGIOUS INSTITUTIONS AN INDISPENSABLE GUIDE RELATING TO TAX AND OTHER MATTERS FOR VOLUNTARY AGENCIES. AS AMENDED BY THE FINANCE (No.2) ACT, 2024 Revised Registration Procedure Condonation of delay reintroduced Inter Charity Application of Income Merger of the first regime with the second regime Procedure for Approval under Section 80G

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Chartered Accountant’s – Documentation and Compliance for Audits and Reviews by CA Pramod Jain – 12th Edition 2025

- ₹2,995.00

- Chartered Accountant's - Documentation and Compliance for Audits and Reviews by CA Pramod Jain - 12th Edition 2025

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Chartered Accountant’s Documentation and Compliance for Audits and Reviews by CA Pramod Jain & CA Shreya Jain – 11th Edition 2023

- ₹2,585.00

- Chartered Accountant's Documentation and Compliance for Audits and Reviews by CA Pramod Jain & CA Shreya Jain - 11th Edition 2023

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Children’s Views and Evidence by David Burrows – Edition 2017

- ₹7,182.00

- Children’s Views and Evidence by David Burrows - Edition 2017

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Circulars, Clarifications, Instructions & Orders Under GST Law by Motlani & Mahajan – 8th Edition 2024

- ₹1,345.00

- Circulars, Clarifications, Instructions & orders Under GST Law by Motlani & Mahajan - 8th Edition 2024

- Add to basket

-

- Out of StockSale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Circulars, Clarifications, Instructions & Orders Under GST Law by Motlani & Mahajan – 8th Edition 2024

- ₹1,345.00

- Circulars, Clarifications, Instructions & orders Under GST Law by Motlani & Mahajan – 8th Edition 2024

- Read more

-

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Circulars, Clarifications, Instructions & Orders With Analysis by PH MOTLANI & JATIN SEHGAL,Hanumant Gidwani – 9th Edition 2024-25

- ₹1,871.00

- Circulars, Clarifications, Instructions & Orders With Analysis by PH MOTLANI & JATIN SEHGAL,Hanumant Gidwani - 9th Edition 2024-25

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Classification of Goods and Services under GST/Customs & other Indirect Tax Laws by R K Jain – Edition 2025

- ₹1,865.00

- Classification of Goods and Services under GST/Customs & other Indirect Tax Laws by R K Jain - Edition 2025

- Add to basket

-

- Sale!

- Budget Editions 2025, TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

COMBO for Direct Taxes – Income Tax Act 2025, Income Tax Rules 2025 & Direct Taxes Ready Reckoner 2025 | Finance Act 2025 Edition | IT (Fifth Amdt.) Rules 2025 | AYs 2025-26 & 2026-27 | Set of 3 Books – Edition 2025

- ₹6,065.00

- COMBO for Direct Taxes - Income Tax Act 2025, Income Tax Rules 2025 & Direct Taxes Ready Reckoner 2025 | Finance Act 2025 Edition | IT (Fifth Amdt.) Rules 2025 | AYs 2025-26 & 2026-27 | Set of 3 Books - Edition 2025

- Add to basket

-

- Sale!

- Budget Editions 2025, TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

COMBO for Direct Taxes – Master Guide to Income Tax Act and Rules 2025 & Direct Taxes Ready Reckoner (DTRR) 2025 | Finance Act 2025 | IT (Fifth-Amdt.) Rules 2025 | Set of 3 Books – Edition 2025

- ₹6,180.00

- COMBO for Direct Taxes - Master Guide to Income Tax Act and Rules 2025 & Direct Taxes Ready Reckoner (DTRR) 2025 | Finance Act 2025 | IT (Fifth-Amdt.) Rules 2025 | Set of 3 Books - Edition 2025

- Add to basket

-

- Sale!

- Budget Editions 2025, TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Combo of Income Tax Act 2025, Income Tax Rules 2025 & Direct Tax Ready Reckoner by : Dr. Girish Ahuja & Dr. Ravi Gupta – 14th Edition 2025

- ₹5,525.00

- Combo of Income Tax Act 2025, Income Tax Rules 2025 & Direct Tax Ready Reckoner by : Dr. Girish Ahuja & Dr. Ravi Gupta - 14th Edition 2025

- Add to basket

-

- Sale!

- Budget Editions 2025, TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

COMMENTARY COMBO for Direct Taxes – Master Guide to Income Tax Act 2025 and Rules 2025 & Direct Taxes Law & Practice | Finance Act 2025 | IT (5th Amdt.) Rules 2025 | Set of 3 Books – by Vinod K. Singhania, Kapil Singhania

- ₹7,835.00

- COMMENTARY COMBO for Direct Taxes - Master Guide to Income Tax Act 2025 and Rules 2025 & Direct Taxes Law & Practice | Finance Act 2025 | IT (5th Amdt.) Rules 2025 | Set of 3 Books - by Vinod K. Singhania, Kapil Singhania

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Commentary Combo on Direct Taxes — Master Guide to Income Tax Act and Rules & Direct Taxes Ready Reckoner (DTRR) | Finance (No. 2) Act 2024 | IT (Sixth-Amdt.) Rules 2024 | Set of 3 Books

- ₹5,675.00

- Commentary Combo on Direct Taxes — Master Guide to Income Tax Act and Rules & Direct Taxes Ready Reckoner (DTRR) | Finance (No. 2) Act 2024 | IT (Sixth-Amdt.) Rules 2024 | Set of 3 Books

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

COMMENTARY ON THE BHARATIYA NAGARIK SURAKSHA SANHITA, 2023 (ACT No 46 of 2023) by Sarkar(Set of 2 Vol.)

- ₹4,495.00

- COMMENTARY ON THE BHARATIYA NAGARIK SURAKSHA SANHITA, 2023 (ACT No 46 of 2023) by Sarkar (Set of 2 Vol.)

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

COMMENTARY ON THE BHARATIYA SAKSHYA ADHINIYAM, 2023 ACT No. 47 of 2023 (set of 2 vol.) by Sarkar

- ₹4,495.00

- COMMENTARY ON THE BHARATIYA SAKSHYA ADHINIYAM, 2023 (ACT No. 47 of 2023 ) set of 2 vol. by Sarkar

- Add to basket

-

- Out of StockSale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Commercial Ind As Ready Reckoner by Parveen Sharma & Kapileshwar Bhalla – Edition 2023

- ₹2,085.00

- Ind As Ready Reckoner by Parveen Sharma & Kapileshwar Bhalla – Edition 2023

- Read more

-

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Commercial’s COMPANIES ACT 2013 And Rules & Forms with Concise Commentary and Referencer – 18th Edition 2025 In 2 vols

- ₹2,995.00

- COMPANIES ACT 2013 And Rules & Forms with Concise Commentary and Referencer - 18th Edition

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Commercial’s GST Incorporating

- ₹1,045.00

- Commercial's GST Incorporating

- Add to basket

-

- Out of StockSale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

COMMERCIAL’S GST Ready Reckoner as Amended by Finance Act, 2023

- ₹2,000.00

- Commentary for Easy Understanding. Question and Answer form. Pictorial Representations. Process Flow in Flow charts. Judicials Pronouncement. Notifications & circulars till 01-04-2023

- Read more

-

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Commercial’s Handbook on Drawback of Duties & Taxes by R Krishnan & R Parthasarathy 17th Edition 2024

- ₹1,260.00

- All Industry Rates of Duty Drawback, 2023-2024 (Vide Noti. No. 77/2023 Cus. (NT) Dt. 20-10-2023, w.e.f. 30-10-2023) Rebate of State Levies on Export of Garments Remission of Duties and Taxes on Exported Products (RoDTEP Scheme) Refund of Taxes Paid under the GST Regime w.e.f. 1-7-2017 Refund of Customs Duties on Re-export of Goods

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Commercial’s Systematic Approach to Income Tax 49th Edition Dr. Girish Ahuja for May 2024 Exam

- ₹920.00

- A Simplified approach to the understanding of a complex subject written in a unique, simple, easy to understand language that enables a quicker grasp for the student. The topics are explained with the help of Tabular and Graphical Presentation to make it simple for students to understand the concept. Each topic after a theoretical exposition, is followed by plenty of…

- Add to basket

-

- Out of StockSale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Commercial’s Direct Taxes Ready Reckoner with Tax Planning by Girish Ahuja & Ravi Gupta – 24th Edition 2023

- ₹1,200.00

- Commercial’s Direct Taxes Ready Reckoner with Tax Planning by Girish Ahuja & Ravi Gupta – 24th Edition 2023

- Read more

-

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Commercial’s Expenditure Not Includible In Total Income by Ram Dutt Sharma – 2nd Edition 2023

- ₹435.00

- Applicability of Section14A Read with Rule 8D Under Income Tax Law

- Add to basket

-

- Out of StockSale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Commercial’s Filing of Indian Income Tax Updated Return by Ram Dutt Sharma – Edition 2023

- ₹210.00

- Under Sections 139 ( 8A) of Income Tax Act, 1961

- Read more

-

-

- Out of StockSale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

COMPANIES (AUDITOR’S REPORT) ORDER, 2020 (CARO) by CA. Kamal Garg – 6th Edition 2023

- ₹1,400.00

- COMPANIES (AUDITOR’S REPORT) ORDER, 2020 (CARO) by CA. Kamal Garg - 6th Edition 2023

- Read more

-

-

- Out of StockSale!

- COMPANY LAW, CORPORATE LAWS, BUSINESS LAW, SEBI, SECURITIES, STOCK, FEMA, COMPETITION, TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Companies Act with Rules – 21st Edition 2024

- ₹1,685.00

- Companies Act with Rules - 21st Edition 2024

- Read more

-

-

- Sale!

- COMPANY LAW, CORPORATE LAWS, BUSINESS LAW, SEBI, SECURITIES, STOCK, FEMA, COMPETITION, TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Companies Act with Rules (Royal Edition) – 44th (July) Edition 2025

- ₹2,045.00

- Companies Act with Rules (Royal Edition) - 44th (July) Edition 2025

- Add to basket

-

- Out of StockSale!

- COMPANY LAW, CORPORATE LAWS, BUSINESS LAW, SEBI, SECURITIES, STOCK, FEMA, COMPETITION, TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Companies Act with Rules (Royal Edition) by Bharat – 42nd Edition 2024

- ₹1,850.00

- Companies Act with Rules (Royal Edition) by Bharat - 42nd Edition 2024

- Read more

-

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Companies Act, 2013 with Prescribed Company Rules and Case Laws by Mamta Bhargava – Edition 2025

- ₹1,875.00

- Companies Act, 2013 with Prescribed Company Rules and Case Laws by Mamta Bhargava - Edition 2025

- Add to basket

-

- Sale!

- COMPANY LAW, CORPORATE LAWS, BUSINESS LAW, SEBI, SECURITIES, STOCK, FEMA, COMPETITION, TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

COMPANIES ACT, 2013 with RULES (Pkt edn.) – 42nd Edition (July) 2025

- ₹750.00

- COMPANIES ACT, 2013 with RULES (Pkt edn.) - 42nd Edition (July) 2025

- Add to basket

-

- Out of StockSale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Company Balance Sheet and Profit & Loss Account under Accounting Standards & Schedule III (for the F. Y. 2022-2023) by CA. Kamal Garg – 10th Edition 2023

- ₹1,999.00

- Company Balance Sheet and Profit & Loss Account under Accounting Standards & Schedule III (for the F. Y. 2022-2023) by CA. Kamal Garg - 10th Edition 2023

- Read more

-

-

- Out of StockSale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Company Balance Sheet and Profit & Loss Account under Accounting Standards & Schedule III (for the F. Y. 2023-2024) by CA. Kamal Garg – 11th Edition 2024

- ₹2,095.00

- Company Balance Sheet and Profit & Loss Account under Accounting Standards & Schedule III (for the F. Y. 2023-2024) by CA. Kamal Garg - 11th Edition 2024

- Read more

-

-

- Out of StockSale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Company Financial Statements and Audit, 2023 by CS Amit Bax – Edition 2023

- ₹1,285.00

- Company Financial Statements and Audit, 2023 by CS Amit Bax - Edition 2023

- Read more

-

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Company law & Practice by CS Amit Vohra for 24th EDITION Dec 2023 Exam

- ₹635.00

- About COMPANY LAW & PRACTICE Chapter 1 Introduction to Companies Chapter 2 Definitions under Companies Act, 2013 Chapter 3 Classification of Companies Chapter 4 Promotion & Formation of Companies Chapter 5 Memorandum and Articles of Association of Company Chapter 6 Membership Chapter 7 Transfer & Transmission Chapter 8 Share Capital Chapter 9 Debentures Chapter 10 Acceptance of Deposits by Companies Chapter 11 Charges Chapter 12 Registers and Returns Chapter 13 Divisible Profits & Dividends Chapter 14 Accounts Chapter 15 Audit Chapter 16 Inspection, Investigation and Inquiry Chapter…

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Company Law Handbook 2017 by Dr Saleem Sheikh – Edition 2017

- ₹14,365.00

- Company Law Handbook 2017 by Dr Saleem Sheikh - Edition 2017

- Add to basket

-

- Out of StockSale!

- COMPANY LAW, CORPORATE LAWS, BUSINESS LAW, SEBI, SECURITIES, STOCK, FEMA, COMPETITION, TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Company Law Manual – 21st Edition 2024

- ₹2,395.00

- Company Law Manual - 21st Edition 2024

- Read more

-

-

- Sale!

- COMPANY LAW, CORPORATE LAWS, BUSINESS LAW, SEBI, SECURITIES, STOCK, FEMA, COMPETITION, TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Company Law Practice Made Easy for CA & CS by CS Amit Baxi – Edition 2024

- ₹1,475.00

- Company Law Practice Made Easy for CA & CS by CS Amit Baxi - Edition 2024

- Add to basket

-

- Sale!

- COMPANY LAW, CORPORATE LAWS, BUSINESS LAW, SEBI, SECURITIES, STOCK, FEMA, COMPETITION, TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

COMPANY LAW PROCEDURES & COMPLIANCES by Dr. Sanjeev Gupta (Set of 2 volumes) – 4th Edition 2025 (with FREE e-Book)

- ₹3,745.00

- COMPANY LAW PROCEDURES & COMPLIANCES by Dr. Sanjeev Gupta (Set of 2 volumes) - 4th Edition 2025 (with FREE e-Book)

- Add to basket

-

- Sale!

- COMPANY LAW, CORPORATE LAWS, BUSINESS LAW, SEBI, SECURITIES, STOCK, FEMA, COMPETITION, TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Company Law Ready Reckoner by Dr. D.K. Jain (Set of 2 Vols.) [with free e-book] – 26th Edition 2024

- ₹3,395.00

- Company Law Ready Reckoner by Dr. D.K. Jain (Set of 2 Vols.) [with free e-book] - 26th Edition 2024

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Company Law Ready Reckoner by Taxmann – 16th Edition 2025

- ₹1,750.00

- Company Law Ready Reckoner by Taxmann - 16th Edition 2025

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Company Law Ready Referencer by CA Sanjay K Agarwal & CS Rupanjana De – 9th Edition 2025

- ₹2,245.00

- Company Law Ready Referencer by CA Sanjay K Agarwal & CS Rupanjana De - 9th Edition 2025

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Company Meetings by Dr. Rajeev Babel – 1st Edition 2025

- ₹1,125.00

- Company Meetings by Dr. Rajeev Babel - 1st Edition 2025

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Comparative Capital Punishment by Carol S. Steiker – Edition 2019

- ₹22,995.00

- Comparative Capital Punishment by Carol S. Steiker - Edition 2019

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Competitive Accountability in Academic Life by Richard Watermeyer – Edition 2020

- ₹3,070.00

- Competitive Accountability in Academic Life by Richard Watermeyer - Edition 2020

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Compilation of GENERAL FINANCIAL RULES 2017 – Edition 2024

- ₹400.00

- Compilation of GENERAL FINANCIAL RULES 2017 - Edition 2024

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Complete EU Law Text, Cases, and Materials by Elspeth Berry, Barbara Bogusz, Matthew Homewood, and Sophie Strecker – 5th Edition 2022

- ₹5,025.00

- Complete EU Law Text, Cases, and Materials by Elspeth Berry, Barbara Bogusz, Matthew Homewood, and Sophie Strecker - 5th Edition 2022

- Add to basket

-

- Sale!

- CRIMINAL LAWS, MINOR ACTS,PMLA,WHITE COLLAR CRIMES, SCST, TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Comprehensive Guide on Benami Law By Raj Kumar Nahataa

- ₹1,525.00

- The publication is a comprehensive guide on complexities surrounding benami law and its jurisprudence in India, providing in-depth analytical and critical analysis of each and every aspect related to Benami Transactions. The book traces the origin, history and evolution of the benami law and paints an impartial picture by including both side’s views carved out of the decisions of the…

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Comprehensive Guide to Reverse Charge under GST by CA Dhruv Dedhia & CA Vinay Kumar – Edition 2024

- ₹745.00

- Comprehensive Guide to Reverse Charge under GST by CA Dhruv Dedhia & CA Vinay Kumar - Edition 2024

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Concise Commentary on Income Tax & International Taxation (With Tax Planning / Problems & Solutions) by Dr. Girish Ahuja & Dr. Ravi Gupta (Set of 2 Vols.) – 26th Edition 2025

- ₹4,725.00

- Concise Commentary on Income Tax & International Taxation (With Tax Planning / Problems & Solutions) by Dr. Girish Ahuja & Dr. Ravi Gupta (Set of 2 Vols.) - 26th Edition 2025

- Add to basket

-

- Out of StockSale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Concise Commentary on Income Tax by Dr. Girish Ahuja & Dr. Ravi Gupta (Set of 2 Vols.) – 24th Edition 2023

- ₹4,065.00

- Concise Commentary on Income Tax by Dr. Girish Ahuja & Dr. Ravi Gupta (Set of 2 Vols.) - 24th Edition 2023

- Read more

-

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Concise Commentary on Income Tax by Dr. Girish Ahuja Dr. Ravi Gupta (Set of 2 Vols.) – 25th Edition 2024

- ₹4,395.00

- Concise Commentary on Income Tax by Dr. Girish Ahuja Dr. Ravi Gupta (Set of 2 Vols.) - 25th Edition 2024

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Concise Commentary On Income Tax with Tax Planning / Problems & Solutions (2 Vols. Set) by Dr. Girish Ahuja, Dr. Ravi Gupta – 25th Edition 2024

- ₹4,195.00

- Concise Commentary On Income Tax with Tax Planning / Problems & Solutions (2 Vols. Set) by Dr. Girish Ahuja, Dr. Ravi Gupta - 25th Edition 2024

- Add to basket

-

- Sale!

- COMPANY LAW, CORPORATE LAWS, BUSINESS LAW, SEBI, SECURITIES, STOCK, FEMA, COMPETITION, TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Corporate Law Referencer (Set of 2 Volumes) By Sumit Pahwa – 11th Edition 2025 (April)

- ₹3,700.00

- Corporate Law Referencer (Set of 2 Volumes) By Sumit Pahwa - 11th Edition 2025 (April)

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Corporate Social Responsibility by CA. Kamal Garg – 5th Edition 2025

- ₹795.00

- Corporate Social Responsibility by CA. Kamal Garg - 5th Edition 2025

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Cost and Management Accounting by S.Shalini

- ₹335.00

- Cost and Management Accounting by S.Shalini

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Cross-Border Transactions under Tax Laws & FEMA by G. Gokul Kishore, R. Subhashree – 3rd Edition 2023

- ₹1,650.00

- Cross-Border Transactions under Tax Laws & FEMA by G. Gokul Kishore, R. Subhashree - 3rd Edition 2023

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Cross-Border Transactions under Tax Laws & FEMA by G. Gokul Kishore, R. Subhashreeb – Edition 2024

- ₹1,795.00

- Cross-Border Transactions under Tax Laws & FEMA by G. Gokul Kishore, R. Subhashreeb - Edition 2024

- Add to basket

-

- Out of StockSale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Customs Law & Practice with Foreign Trade Policy by V S Datey – 25th Edition 2023

- ₹2,600.00

- Customs Law & Practice with Foreign Trade Policy by V S Datey - 25th Edition 2023

- Read more

-

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Customs Law & Practice with Foreign Trade Policy by V.S. Datey – 26th Edition 2024

- ₹2,620.00

- Customs Law & Practice with Foreign Trade Policy by V.S. Datey - 26th Edition 2024

- Add to basket

-

- Out of StockSale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Customs Law Manual 2023-24 (Set of 2 Vols.) by R.K. Jain – 69th Edition 2023

- ₹2,850.00

- Customs Law Manual 2023-24 (Set of 2 Vols.) by R.K. Jain - 69th Edition 2023

- Read more

-

-

- Out of StockSale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Customs Law Manual 2024-25 by R.K. Jain – 70th Edition 2024

- ₹2,950.00

- Customs Law Manual 2024-25 by R.K. Jain - 70th Edition 2024

- Read more

-

-

- Sale!

- Custom Tax, TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Customs Law Manual by R K Jain (Set of 2 Vols.) – 71st Edition 2024-25

- ₹3,300.00

- Customs Law Manual by R K Jain (Set of 2 Vols.) - 71st Edition 2024-25

- Add to basket

-

- Out of StockSale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Customs Tariff of India 2024-25 by R.K. Jain (Set of 2 Vols.) – 79th Edition 2024

- ₹3,365.00

- Customs Tariff of India 2024-25 by R.K. Jain (Set of 2 Vols.) - 79th Edition 2024

- Read more

-

-

- Out of StockSale!

- Custom Tax, TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Customs Tariff of India by R K Jain (Set of 2 Vols.) – 80th Edition 2024-25

- ₹3,350.00

- Customs Tariff of India by R K Jain (Set of 2 Vols.) - 80th Edition 2024-25

- Read more

-

-

- Out of StockSale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Customs Tariff of India by R.K. Jain (Set of 2 Vols.) – 77th Edition 2023

- ₹3,175.00

- Customs Tariff of India by R.K. Jain (Set of 2 Vols.) - 77th Edition 2023

- Read more

-

-

- Out of StockSale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Customs Tariff with IGST & Foreign Trade Policy by Anshul Garg – Edition 2023

- ₹3,155.00

- Customs Tariff with IGST & Foreign Trade Policy by Anshul Garg - Edition 2023

- Read more

-

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Decoding Section 5 by H Padamchand Khincha, K K Chythanya

- ₹520.00

- Decoding Section 5 by H Padamchand Khincha, K K Chythanya

- Add to basket

-

- Out of StockSale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Deduction of Tax at Source With Advance Tax and Refunds (As amended by Finance Act 2023) By Dr. Vinod K. Singhania – 36th Edition 2023

- ₹1,585.00

- Deduction of Tax at Source With Advance Tax and Refunds (As amended by Finance Act 2023) By Dr. Vinod K. Singhania - 36th Edition 2023

- Read more

-

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Deduction of Tax at Source with Advance Tax and Refunds by Vinod K. Singhania – 37th Editon 2024

- ₹1,575.00

- Deduction of Tax at Source with Advance Tax and Refunds by Vinod K. Singhania - 37th Editon 2024

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Depreciation under Schedule II of Companies Act, 2013 & Income Tax Act, 1961 by CA Kamal Garg – 6th Edition 2024

- ₹1,050.00

- Depreciation under Schedule II of Companies Act, 2013 & Income Tax Act, 1961 by CA Kamal Garg - 6th Edition 2024

- Add to basket

-

- Sale!

- ADMINISTRATIVE LAW/JUDICIAL PROCESS, TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

dierct taxes ready rockoner by Pavan K. Jain – 20th Edition 2024-25

- ₹1,646.00

- dierct taxes ready rockoner by Pavan K. Jain - 20th Edition 2024-25

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Digital Economy & Direct Taxation – An Overview

- ₹555.00

- Digital Economy & Direct Taxation – An Overview

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Direct Tax Law & Practice by Dr. Girish Ahuja & Dr. Ravi Gupta – 17th Professional Edition 2025

- ₹3,135.00

- Direct Tax Law & Practice by Dr. Girish Ahuja & Dr. Ravi Gupta – 17th Professional Edition 2025

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Direct Tax Laws & International taxation for CA Final (Paper 4 Group 2) by CA Arvind Tuli – 17th Edition 2024

- ₹630.00

- Direct Tax Laws & International taxation for CA Final (Paper 4 Group 2) by CA Arvind Tuli - 17th Edition 2024

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Direct Tax Vivad Se Vishwas Scheme,2024 (As Amended by The Finance (No. 2) Act 2024 by Ram Dutt Sharma – Edition 2024

- ₹520.00

- Direct Tax Vivad Se Vishwas Scheme,2024 (As Amended by The Finance (No. 2) Act 2024 by Ram Dutt Sharma - Edition 2024

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Direct Taxes & International Taxation by G Sekar (Set of 2 Vols.) – 1st Edition 2024

- ₹1,850.00

- Direct Taxes & International Taxation by G Sekar (Set of 2 Vols.) - 1st Edition 2024

- Add to basket

-

- Out of StockSale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Direct Taxes Law & Practice – Professional Edition Vinod K. Singhania, Kapil Singhania

- ₹2,975.00

- Taxmann's flagship commentary on Direct Taxes has been the most trusted & bestselling commentary for experienced practitioners for over twenty years. It aims at not only making the reader understand the law but also helping them develop the ability to apply it. In other words, this book aims at providing the reader with the following: Acquire familiarity with the various direct tax provisions…

- Read more

-

-

- Out of StockSale!

- Budget, TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Direct Taxes Law & Practice by Dr Girish Ahuja & Dr Ravi Gupta – 16th Edition 2024

- ₹2,750.00

- Direct Taxes Law & Practice by Dr Girish Ahuja & Dr Ravi Gupta - 16th Edition 2024

- Read more

-

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Direct Taxes Law & Practice By Dr Girish Ahuja Dr Ravi Gupta – Edition April’2023

- ₹2,825.00

- Direct Taxes Law & Practice By Dr Girish Ahuja Dr Ravi Gupta - Edition April'2023

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Direct Taxes Law & Practice by Vinod K. Singhania & Kapil Singhania – Edition 2024

- ₹3,485.00

- Direct Taxes Law & Practice by Vinod K. Singhania & Kapil Singhania - Edition 2024

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Direct Taxes Law & Practice By Vinod K. Singhania, Kapil Singhania – Professional Edition 2025-26 & 2026-27

- ₹3,745.00

- Direct Taxes Law & Practice By Vinod K. Singhania, Kapil Singhania - Professional Edition 2025-26 & 2026-27

- Add to basket

-

- Out of StockSale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Direct Taxes Law & Practice with Special Reference to Tax Planning by Vinod K. Singhania & Kapil Singhania – 69th Edition 2023

- ₹1,915.00

- Direct Taxes Law & Practice with Special Reference to Tax Planning by Vinod K. Singhania & Kapil Singhania – 69th Edition 2023

- Read more

-

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Direct Taxes Manual (Set of 3 Vols.) – 32nd Edition 2024

- ₹5,845.00

- Direct Taxes Manual (Set of 3 Vols.) - 32nd Edition 2024

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Direct Taxes Manual by Bharat Law House (Set of 3 Vols.) – 33rd Edition 2025

- ₹5,845.00

- Direct Taxes Manual by Bharat Law House (Set of 3 Vols.) - 33rd Edition 2025

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Direct Taxes Manual by Taxmann (Set of 3 Volumes) – 55th Edition 2025

- ₹6,335.00

- Direct Taxes Manual by Taxmann (Set of 3 Volumes) - 55th Edition 2025

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Direct Taxes Ready Reckoner by CA. Arvind Tuli – 12th Edition 2024

- ₹1,600.00

- Direct Taxes Ready Reckoner by CA. Arvind Tuli - 12th Edition 2024

- Add to basket

-

- Sale!

- Budget Editions 2025, TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Direct Taxes Ready Reckoner By Vinod K. Singhania – 49th Edition 2025-2026 & 2026-2027

- ₹1,875.00

- Direct Taxes Ready Reckoner By Vinod K. Singhania - 49th Edition 2025-2026 & 2026-2027

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Direct Taxes Ready Reckoner with Tax Planning by Dr Girish Ahuja & Dr Ravi Gupta – 26th Edition 2025

- ₹1,645.00

- Direct Taxes Ready Reckoner with Tax Planning by Dr Girish Ahuja & Dr Ravi Gupta – 26th Edition 2025

- Add to basket

-

- Out of StockSale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Direct Taxes Ready Reckoner with Tax Planning by Girish Ahuja & Ravi Gupta – 25th Edition 2024

- ₹1,375.00

- Direct Taxes Ready Reckoner with Tax Planning by Girish Ahuja & Ravi Gupta – 25th Edition 2024

- Read more

-

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Double Taxation Treaties (Concepts, Practices & Trends) by K R Sekar (Set of 2 Vols.) – 1st Edition 2024

- ₹3,500.00

- Double Taxation Treaties (Concepts, Practices & Trends) by K R Sekar (Set of 2 Vols.) - 1st Edition 2024

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Driverless Finance (Fintech’s Impact on Financial Stability) by Hilary J. Allen – Edition 2022

- ₹3,460.00

- Driverless Finance (Fintech's Impact on Financial Stability) by Hilary J. Allen - Edition 2022

- Add to basket

-

- Out of StockSale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Elements of Auditing by Aruna Jha, Anuj Bhatia, Ruchi Gupta – Edition 2024

- ₹315.00

- Elements of Auditing by Aruna Jha, Anuj Bhatia, Ruchi Gupta – Edition 2024

- Read more

-

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Emerging Issues in International Taxation

- ₹635.00

- Emerging Issues in International Taxation

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Environmental Law by Stuart Bell,Donald McGillivray,Ole Pedersen,Elen Stokes – 10th Edition 2024

- ₹4,460.00

- Environmental Law by Stuart Bell,Donald McGillivray,Ole Pedersen,Elen Stokes - 10th Edition 2024

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

ERISA Principles by Peter J. Wiedenbeck – Edition 2024

- ₹13,850.00

- ERISA Principles by Peter J. Wiedenbeck - Edition 2024

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

ERISA Principles by Peter J. Wiedenbeck – Edition 2024

- ₹4,615.00

- ERISA Principles by Peter J. Wiedenbeck - Edition 2024

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

European Union Law by Anthony Arnull – Edition 2017

- ₹315.00

- European Union Law by Anthony Arnull - Edition 2017

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

European Union Law Text and Materials by Damian Chalmers – Edition 2023

- ₹5,130.00

- European Union Law Text and Materials by Damian Chalmers - Edition 2023

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Exporters Manual As Per New Foreign Trade Policy and Procedures – Edition 2023

- ₹465.00

- Exporters Manual As Per New Foreign Trade Policy and Procedures - Edition 2023

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

FACELESS Appeals, Revisions & Judicial Review by R P Garg and Beenu Yadav – 3rd Edition 2023

- ₹1,475.00

- FACELESS Appeals, Revisions & Judicial Review by R P Garg and Beenu Yadav - 3rd Edition 2023

- Add to basket

-

- Out of StockSale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Faceless Assessment Appeals & Penalty Ready Reckoner with Practical Guide to Handling Income Tax Notices by Mayank Mohanka – 7th Edition 2024

- ₹1,390.00

- Faceless Assessment Appeals & Penalty Ready Reckoner with Practical Guide to Handling Income Tax Notices by Mayank Mohanka - 7th Edition 2024

- Read more

-

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Faceless Assessment Appeals & Penalty Ready Reckoner with Practical Guide to Handling Income Tax Notices By Mayank Mohanka – 8th Edition 2025

- ₹1,385.00

- Faceless Assessment Appeals & Penalty Ready Reckoner with Practical Guide to Handling Income Tax Notices By Mayank Mohanka - 8th Edition 2025

- Add to basket

-

- Out of StockSale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Faceless Assessment Appeals & Penalty Ready Reckoner by Mayank Mohanka – 6th Edition 2023

- ₹1,180.00

- Faceless Assessment Appeals & Penalty Ready Reckoner by Mayank Mohanka – 6th Edition 2023

- Read more

-

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Fake And Fabricated Documents by M L Bhargava – 2nd Edition 2024

- ₹742.00

- Fake And Fabricated Documents by M L Bhargava - 2nd Edition 2024

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Financial Statements Demystified by B.D. Chatterjee – 1st Edition 2025

- ₹1,195.00

- Financial Statements Demystified by B.D. Chatterjee - 1st Edition 2025

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Financial Statements of Non-Corporate Entities by CA. KAMAL GARG – 1st Edition 2025

- ₹875.00

- Financial Statements of Non-Corporate Entities by CA. KAMAL GARG - 1st Edition 2025

- Add to basket

-

- Sale!

- CYBER LAW / INFORMATION TECHNOLOGY / COMPUTER, INTERNET & E-COMMERCE, MOBILE LAW, TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

FinTech Finance, Technology and Regulation by Ross P. Buckley – Edition 2023

- ₹9,235.00

- FinTech Finance, Technology and Regulation by Ross P. Buckley - Edition 2023

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Foreign Exchange Management Manual by Taxmann’s Editorial Board (Set of 2 Vols.) – 45th Edition 2025

- ₹5,245.00

- Foreign Exchange Management Manual by Taxmann’s Editorial Board – 45th Edition 2025

- Add to basket

-

- Out of StockSale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Foreign Exchange Management Manual with FEMA and FDI Ready Reckoner & FEMA Case Laws Digest (Set of 2 Vols.) – 43rd Edition 2024

- ₹5,000.00

- Foreign Exchange Management Manual with FEMA and FDI Ready Reckoner & FEMA Case Laws Digest (Set of 2 Vols.) - 43rd Edition 2024

- Read more

-

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Foreign Exchange Management Manual with FEMA and FDI Ready Reckoner & FEMA Case Laws Digest (Set of 2 Vols.) – 44th Edition 2024

- ₹5,245.00

- Foreign Exchange Management Manual with FEMA and FDI Ready Reckoner & FEMA Case Laws Digest (Set of 2 Vols.) - 44th Edition 2024

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Forensic Audit by CA. Kamal Garg – 2nd Edition 2025

- ₹635.00

- Forensic Audit by CA. Kamal Garg - 2nd Edition 2025

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Formation Management & Taxation of HINDU UNDIVIDED FAMILIES (HUF) As amended by The Finance Act, 2025 by RAM DUTT SHARMA – 5th Edition 2025

- ₹1,425.00

- Formation Management & Taxation of HINDU UNDIVIDED FAMILIES (HUF) As amended by The Finance Act, 2025 by RAM DUTT SHARMA - 5th Edition 2025

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Formation Management And Taxation Of Charitable And Religious Trust & Institutions Under Income Tax Laws As Amended By Finance Act, 2025 by RAM DUTT SHARMA – 10th Edition 2025

- ₹2,245.00

- Formation Management And Taxation Of Charitable And Religious Trust & Institutions Under Income Tax Laws As Amended By Finance Act, 2025 by RAM DUTT SHARMA - 10th Edition 2025

- Add to basket

-

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Gold & Taxation by Meenakshi Subramaniam – 2nd Edition 2023

- ₹395.00

- Gold & Taxation by Meenakshi Subramaniam - 2nd Edition 2023

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Goods & Services Tax: Law, Practice & Procedure (2 Volume)

- ₹1,995.00

- Goods & Services Tax: Law, Practice & Procedure (2 Volume)

- Add to basket

-

- Out of StockSale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

GST & Allied Laws (A Comprehensive Commentary on Application of Allied Laws to GST) by CA A Jatin Christopher –

- ₹950.00

- GST & Allied Laws (A Comprehensive Commentary on Application of Allied Laws to GST) by CA A Jatin Christopher -

- Read more

-

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

GST & Allied Laws By A Jatin Christopher – 3rd Edition 2025

- ₹1,045.00

- GST & Allied Laws By A Jatin Christopher - 3rd Edition 2025

- Add to basket

-

- Out of StockSale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

GST Acts Along with Rules (Bare Act) – Updated upto 1st Feb 2023 – Edition 2023

- ₹1,035.00

- GST Acts Along with Rules (Bare Act) – Updated upto 1st Feb 2023 - Edition 2023

- Read more

-

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

GST Acts with Rules by Taxmann – 3rd Edition 2024

- ₹710.00

- GST Acts with Rules by Taxmann - 3rd Edition 2024

- Add to basket

-

- Out of StockSale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

GST Acts with Rules/Forms & Notifications – 15th Edition 2024

- ₹1,550.00

- GST Acts with Rules/Forms & Notifications - 15th Edition 2024

- Read more

-

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

GST Amnesty Scheme 2024 by CA. Ashok Batra – 1st Edition 2025

- ₹675.00

- GST Amnesty Scheme 2024 by CA. Ashok Batra - 1st Edition 2025

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

GST ANNUAL RETURNS AND RECONCILIATION STATEMENT BY MANOJ KUMAR GOYAL EDITION 2024

- ₹1,835.00

- HIGHLIGHTS Clause by Clause Analysis of GSTR-9 and GSTR-9c Incorporates by Annual Return Forms nad their Filling Prrocdurees Compliances by Taxpayers while Filing Annual Returns Departmental Audit Checks for Provisions of Registration ,Return Filing and Input Tax Credit Meticulous Commentary on GST Laws including GST Returns in general and Annual Returns in Particular FAQs on Annual Returns

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

GST Appeals & Appellate Procedures By CA. (Dr.) SANJIV AGARWAL CA. NEHA SOMANI – Edition 2025

- ₹1,495.00

- G S T Appeals & Appellate Procedures By CA. (Dr.) SANJIV AGARWAL CA. NEHA SOMANI - Edition 2025

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

GST Case Digest (Set of 2 Vols.) by Rajat Mohan – Edition 2025

- ₹4,195.00

- GST Case Digest (Set of 2 Vols.) by Rajat Mohan - Edition 2025

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

GST E-Way Bill by V.S. Datey – 13th Edition 2025

- ₹795.00

- GST E-Way Bill by V.S. Datey - 13th Edition 2025

- Add to basket

-

- Out of StockSale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

GST for Construction Industry by G Natarajan

- ₹760.00

- GST for Construction Industry by G Natarajan

- Read more

-

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

GST for Decision Makers by Rajat Mohan – 3rd Edition 2024

- ₹640.00

- GST for Decision Makers by Rajat Mohan - 3rd Edition 2024

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

GST Gavel – A Litigation Guide by CA. Ritesh Arora – 1st Edition 2025

- ₹1,045.00

- GST Gavel - A Litigation Guide by CA. Ritesh Arora - 1st Edition 2025

- Add to basket

-

- Out of StockSale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

GST How to Meet Your Obligations by S.S. Gupta – 15th Edition 2024

- ₹5,470.00

- GST How to Meet Your Obligations by S.S. Gupta - 15th Edition 2024

- Read more

-

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

GST How to Meet Your Obligations By S.S. Gupta (Set of 2 Vols.) – 16th Edition 2025

- ₹5,995.00

- GST How to Meet Your Obligations By S.S. Gupta (Set of 2 Vols.) - 16th Edition 2025

- Add to basket

-

- Out of StockSale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

GST How to Meet Your Obligations by S.S.Gupta – (Set of 3 Vols.) – 14th Edition 2023

- ₹6,045.00

- GST How to Meet Your Obligations by S.S.Gupta - (Set of 3 Vols.) - 14th Edition 2023

- Read more

-

-

- Out of StockSale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

GST Input Tax Credit by V S Datey – 14th Edition 2024

- ₹965.00

- GST Input Tax Credit by V S Datey - 14th Edition 2024

- Read more

-

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

GST Input Tax Credit By V.S. Datey – 15th Edition 2025

- ₹1,125.00

- GST Input Tax Credit By V.S. Datey - 15th Edition 2025

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

GST Inspection, Search & Seizure by CA Sanjiv Agarwal & CA Neha Somani – 2nd Edition 2024

- ₹1,400.00

- GST Inspection, Search & Seizure by CA Sanjiv Agarwal & CA Neha Somani - 2nd Edition 2024

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

GST Investigations Demands Appeals & Prosecution By G. Gokul Kishore & R. Subhashree – 4th Edition 2025

- ₹975.00

- GST Investigations Demands Appeals & Prosecution By G. Gokul Kishore & R. Subhashree - 4th Edition 2025

- Add to basket

-

- Out of StockSale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS