-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Commercial’s COMPANIES ACT 2013 And Rules & Forms with Concise Commentary and Referencer – 18th Edition 2025 In 2 vols

- ₹2,995.00

- COMPANIES ACT 2013 And Rules & Forms with Concise Commentary and Referencer - 18th Edition

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

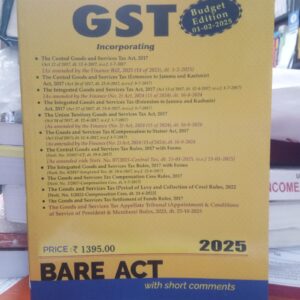

Commercial’s GST Incorporating

- ₹1,045.00

- Commercial's GST Incorporating

- Add to basket

-

- Out of StockSale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

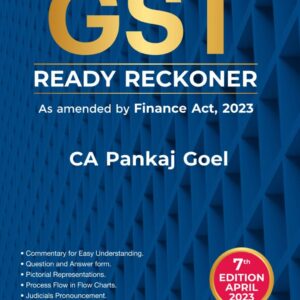

COMMERCIAL’S GST Ready Reckoner as Amended by Finance Act, 2023

- ₹2,000.00

- Commentary for Easy Understanding. Question and Answer form. Pictorial Representations. Process Flow in Flow charts. Judicials Pronouncement. Notifications & circulars till 01-04-2023

- Read more

-

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

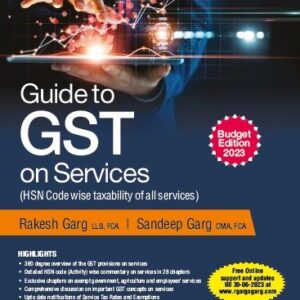

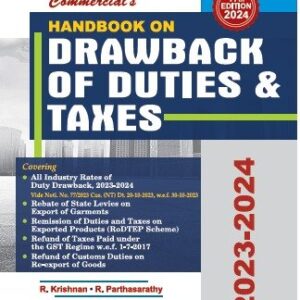

Commercial’s Handbook on Drawback of Duties & Taxes by R Krishnan & R Parthasarathy 17th Edition 2024

- ₹1,260.00

- All Industry Rates of Duty Drawback, 2023-2024 (Vide Noti. No. 77/2023 Cus. (NT) Dt. 20-10-2023, w.e.f. 30-10-2023) Rebate of State Levies on Export of Garments Remission of Duties and Taxes on Exported Products (RoDTEP Scheme) Refund of Taxes Paid under the GST Regime w.e.f. 1-7-2017 Refund of Customs Duties on Re-export of Goods

- Add to basket