-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Complete EU Law Text, Cases, and Materials by Elspeth Berry, Barbara Bogusz, Matthew Homewood, and Sophie Strecker – 5th Edition 2022

- ₹5,025.00

- Complete EU Law Text, Cases, and Materials by Elspeth Berry, Barbara Bogusz, Matthew Homewood, and Sophie Strecker - 5th Edition 2022

- Add to basket

-

- Sale!

- CRIMINAL LAWS, MINOR ACTS,PMLA,WHITE COLLAR CRIMES, SCST, TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Comprehensive Guide on Benami Law By Raj Kumar Nahataa

- ₹1,525.00

- The publication is a comprehensive guide on complexities surrounding benami law and its jurisprudence in India, providing in-depth analytical and critical analysis of each and every aspect related to Benami Transactions. The book traces the origin, history and evolution of the benami law and paints an impartial picture by including both side’s views carved out of the decisions of the…

- Add to basket

-

- Sale!

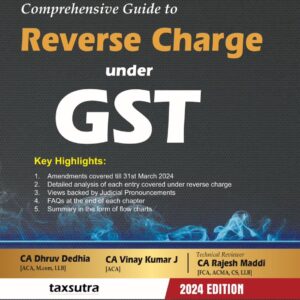

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Comprehensive Guide to Reverse Charge under GST by CA Dhruv Dedhia & CA Vinay Kumar – Edition 2024

- ₹745.00

- Comprehensive Guide to Reverse Charge under GST by CA Dhruv Dedhia & CA Vinay Kumar - Edition 2024

- Add to basket

-

- Sale!

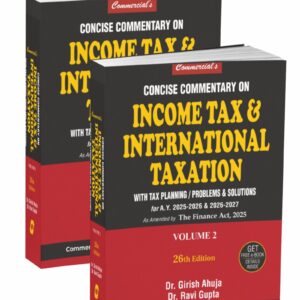

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Concise Commentary on Income Tax & International Taxation (With Tax Planning / Problems & Solutions) by Dr. Girish Ahuja & Dr. Ravi Gupta (Set of 2 Vols.) – 26th Edition 2025

- ₹4,725.00

- Concise Commentary on Income Tax & International Taxation (With Tax Planning / Problems & Solutions) by Dr. Girish Ahuja & Dr. Ravi Gupta (Set of 2 Vols.) - 26th Edition 2025

- Add to basket

-

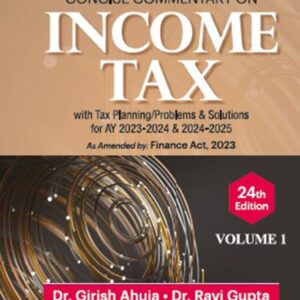

- Out of StockSale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Concise Commentary on Income Tax by Dr. Girish Ahuja & Dr. Ravi Gupta (Set of 2 Vols.) – 24th Edition 2023

- ₹4,065.00

- Concise Commentary on Income Tax by Dr. Girish Ahuja & Dr. Ravi Gupta (Set of 2 Vols.) - 24th Edition 2023

- Read more

-

-

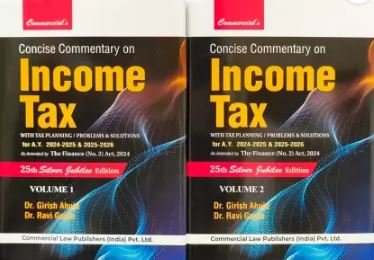

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Concise Commentary on Income Tax by Dr. Girish Ahuja Dr. Ravi Gupta (Set of 2 Vols.) – 25th Edition 2024

- ₹4,395.00

- Concise Commentary on Income Tax by Dr. Girish Ahuja Dr. Ravi Gupta (Set of 2 Vols.) - 25th Edition 2024

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Concise Commentary On Income Tax with Tax Planning / Problems & Solutions (2 Vols. Set) by Dr. Girish Ahuja, Dr. Ravi Gupta – 25th Edition 2024

- ₹4,195.00

- Concise Commentary On Income Tax with Tax Planning / Problems & Solutions (2 Vols. Set) by Dr. Girish Ahuja, Dr. Ravi Gupta - 25th Edition 2024

- Add to basket

-

- Sale!

- COMPANY LAW, CORPORATE LAWS, BUSINESS LAW, SEBI, SECURITIES, STOCK, FEMA, COMPETITION, TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Corporate Law Referencer (Set of 2 Volumes) By Sumit Pahwa – 11th Edition 2025 (April)

- ₹3,700.00

- Corporate Law Referencer (Set of 2 Volumes) By Sumit Pahwa - 11th Edition 2025 (April)

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Corporate Social Responsibility by CA. Kamal Garg – 5th Edition 2025

- ₹795.00

- Corporate Social Responsibility by CA. Kamal Garg - 5th Edition 2025

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Cost and Management Accounting by S.Shalini

- ₹335.00

- Cost and Management Accounting by S.Shalini

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Cross-Border Transactions under Tax Laws & FEMA by G. Gokul Kishore, R. Subhashree – 3rd Edition 2023

- ₹1,650.00

- Cross-Border Transactions under Tax Laws & FEMA by G. Gokul Kishore, R. Subhashree - 3rd Edition 2023

- Add to basket

-

- Sale!

- TAXATION LAW, INDIRECT TAX, DIRECT TAX, INCOME-TAX, GST, TDS, CA BOOKS

Cross-Border Transactions under Tax Laws & FEMA by G. Gokul Kishore, R. Subhashreeb – Edition 2024

- ₹1,795.00

- Cross-Border Transactions under Tax Laws & FEMA by G. Gokul Kishore, R. Subhashreeb - Edition 2024

- Add to basket